Introduction

Real estate short sales can be an effective solution for homeowners facing financial hardship and unable to meet their mortgage obligations. To navigate the short sale process smoothly and increase the chances of a successful outcome in 2023, it is crucial to gather and prepare the required documents. In this comprehensive article, we will provide a detailed list of documents needed for a real estate short sale. These documents serve as crucial evidence of financial hardship, property valuation, and ownership. By having all the necessary paperwork in order, homeowners can streamline the short sale process, negotiate with lenders, and potentially avoid foreclosure.

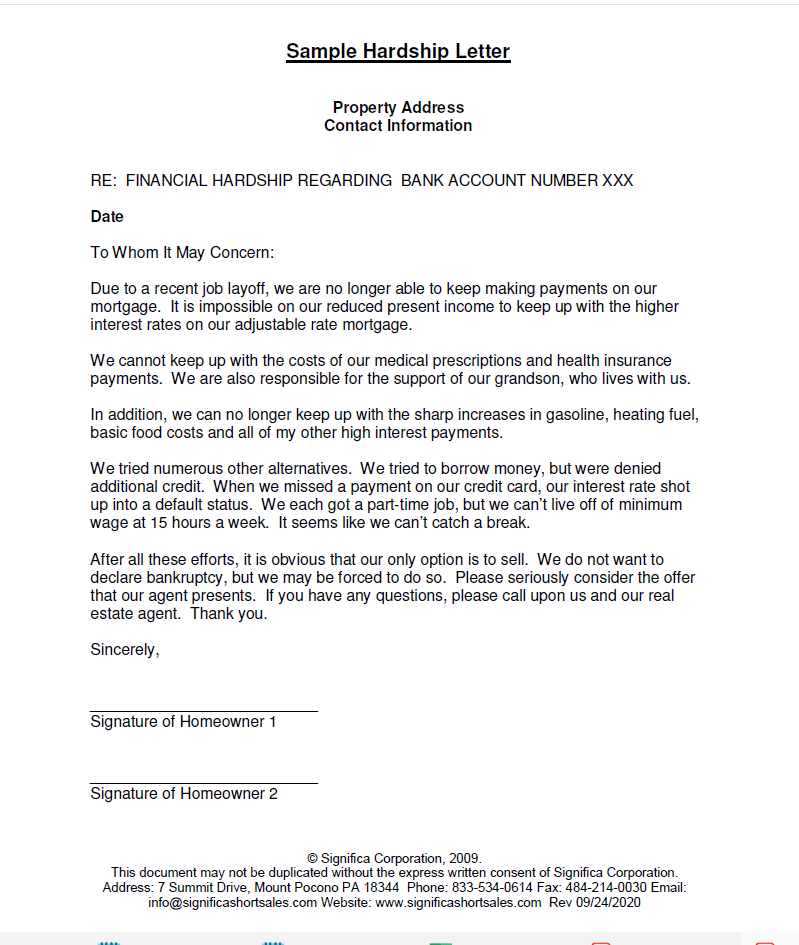

1. Hardship Letter

A well-written hardship letter is a vital component of a real estate short sale package. This letter should clearly and concisely explain the financial difficulties that have led to the need for a short sale. Describe the specific circumstances, such as job loss, reduction in income, medical issues, divorce, or other hardships. The letter should convey a sincere intent to sell the property through a short sale and avoid foreclosure. Supporting documents, such as medical bills, termination notices, or divorce decrees, can be included to strengthen the claims made in the hardship letter.

2. Financial Statements

Lenders require a comprehensive overview of the homeowner’s financial situation to assess eligibility for a short sale. Prepare financial statements, including a detailed breakdown of income, expenses, assets, and liabilities. Provide proof of income, such as recent pay stubs, W-2 forms, or profit and loss statements for self-employed individuals. Include bank statements, investment account statements, and retirement account statements to present a complete picture of the homeowner’s financial health. Mortgage statements, credit card statements, and other debt-related documents should also be included to demonstrate the homeowner’s inability to meet their financial obligations.

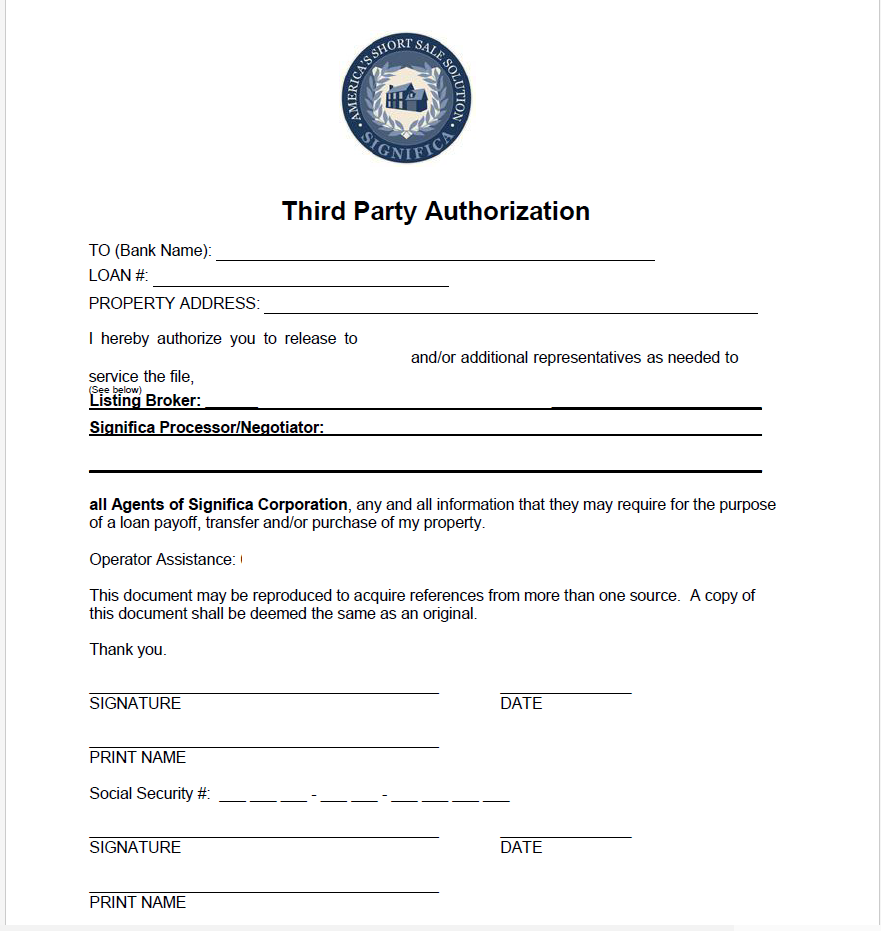

3. Authorization Letter

An authorization letter is necessary to grant the real estate agent or other authorized parties the ability to communicate and negotiate with the lender on behalf of the homeowner. This letter should clearly state the scope of authorization and include the homeowner’s name, property address, loan number, and any other relevant information. It is essential to provide this authorization upfront to ensure smooth communication and facilitate the negotiation process with the lender throughout the short sale transaction.

4. Property Documents

To support the short sale process, gather and organize important property-related documents. These include the deed, title report, property tax statements, and homeowners’ association (HOA) documents. The lender will require these documents to verify ownership and understand any potential liens or encumbrances on the property. Additionally, provide a detailed property profile, including the number of bedrooms, bathrooms, square footage, and any notable features that may affect the property’s value.

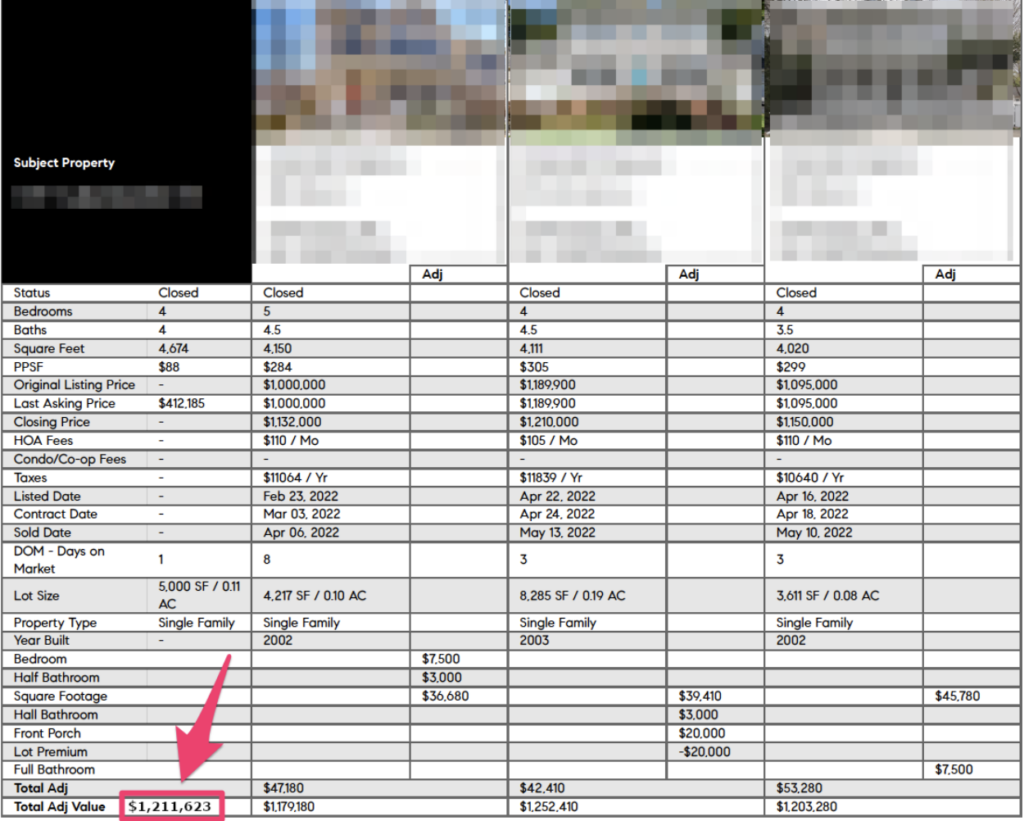

5. Comparative Market Analysis (CMA)

A Comparative Market Analysis (CMA) is a report prepared by a real estate professional that provides an estimate of the property’s market value. This analysis includes recent sales of comparable properties in the area, current listings, and market trends. Including a CMA in the short sale package helps justify the proposed sale price and provides the lender with an objective assessment of the property’s value.

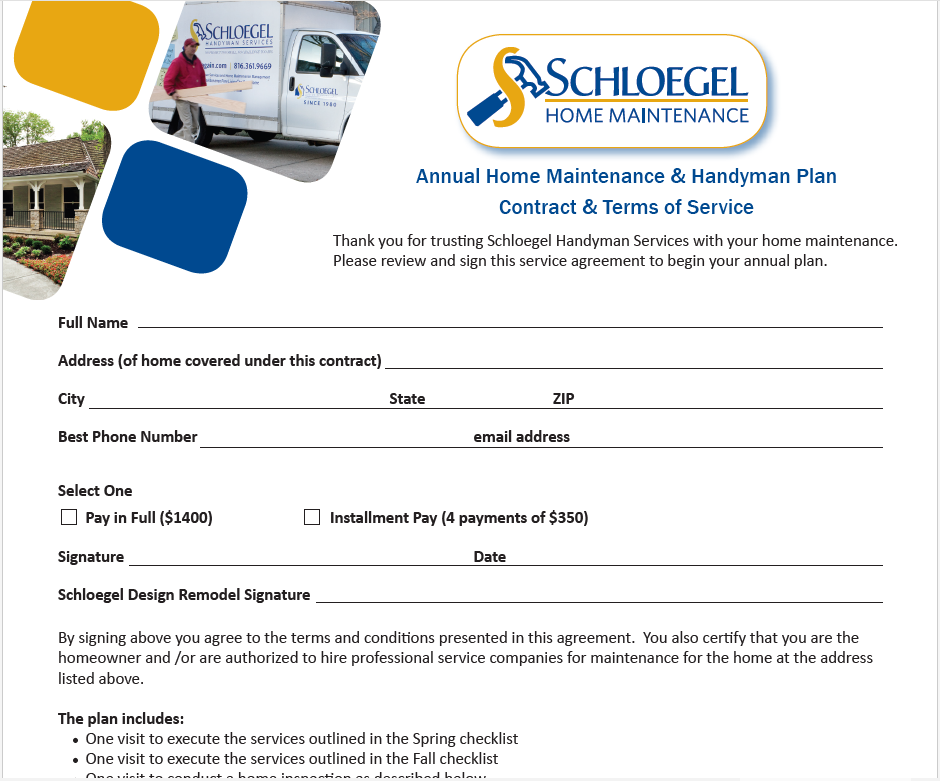

6. Repair and Maintenance Estimates

Lenders may require repair and maintenance estimates to assess the property’s condition and potential repair costs. Obtaining estimates from licensed contractors or qualified professionals can provide a realistic assessment of the property’s repair needs. These estimates help lenders determine the property’s value and evaluate the financial feasibility of the short sale.

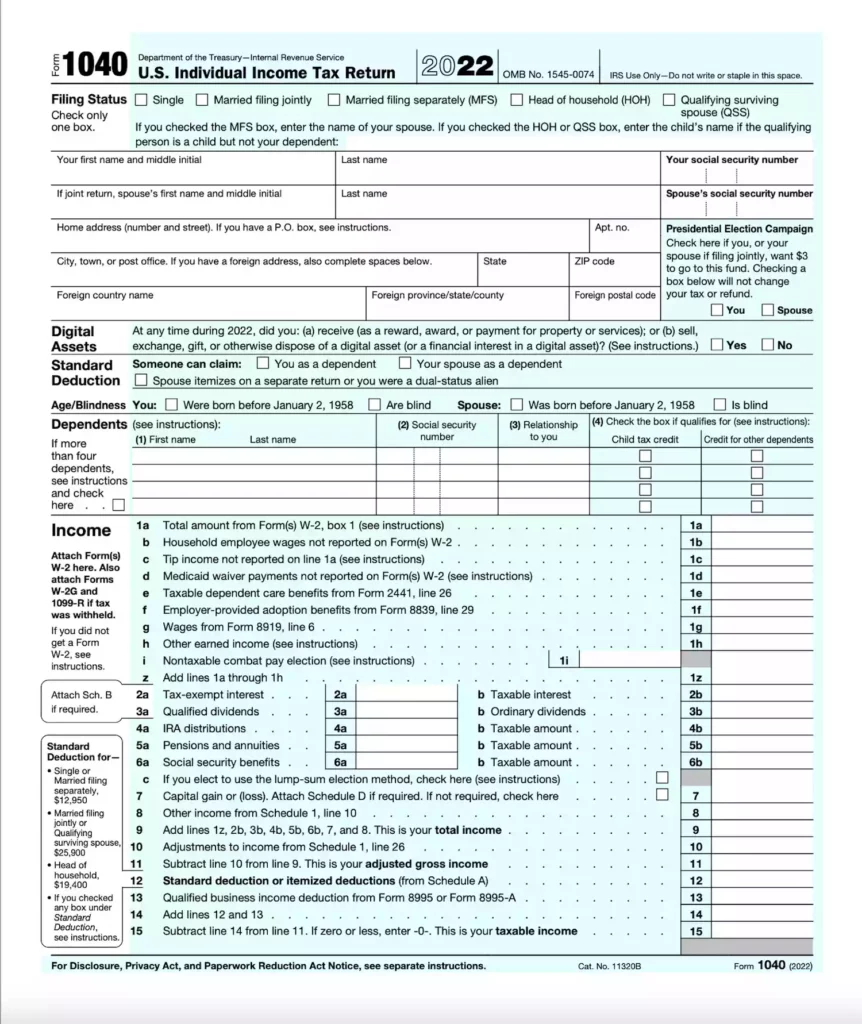

7. Tax Returns and Financial Statements

Lenders typically request the homeowner’s most recent tax returns, including all schedules and attachments. These documents provide additional evidence of the homeowner’s financial situation and income. Additionally, provide the lender with updated financial statements, including balance sheets and profit and loss statements for self-employed individuals. These documents allow the lender to assess the homeowner’s overall financial health and evaluate the viability of the short sale.

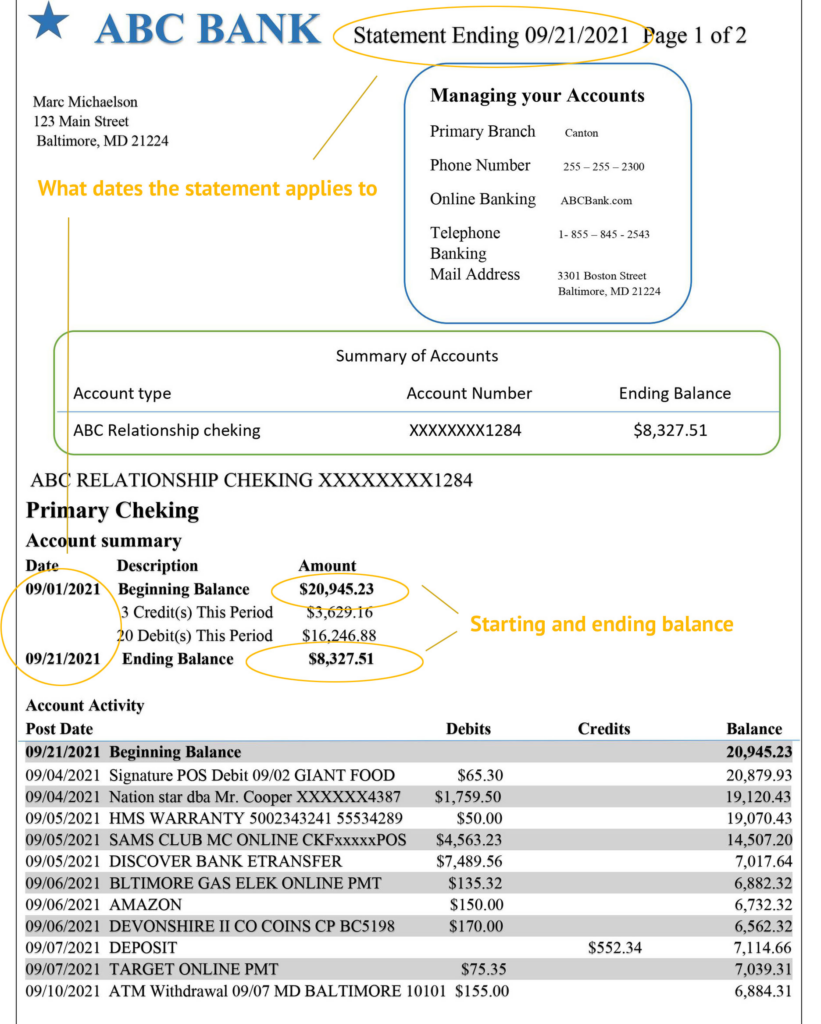

8. Bank Statements

Including recent bank statements is crucial to provide a clear overview of the homeowner’s financial transactions. Submit statements for all bank accounts, including checking, savings, and investment accounts. These statements help the lender verify the homeowner’s financial situation, income, and expenses. It is important to provide consecutive statements covering a period of at least three to six months to ensure a comprehensive view of the homeowner’s financial activity.

9. Payoff Demand Statement

Obtain a payoff demand statement from the mortgage lender. This statement outlines the remaining balance on the mortgage, including principal, interest, and any applicable fees. It is essential to have an accurate and up-to-date payoff demand statement to determine the amount needed to satisfy the existing mortgage and negotiate the terms of the short sale effectively.

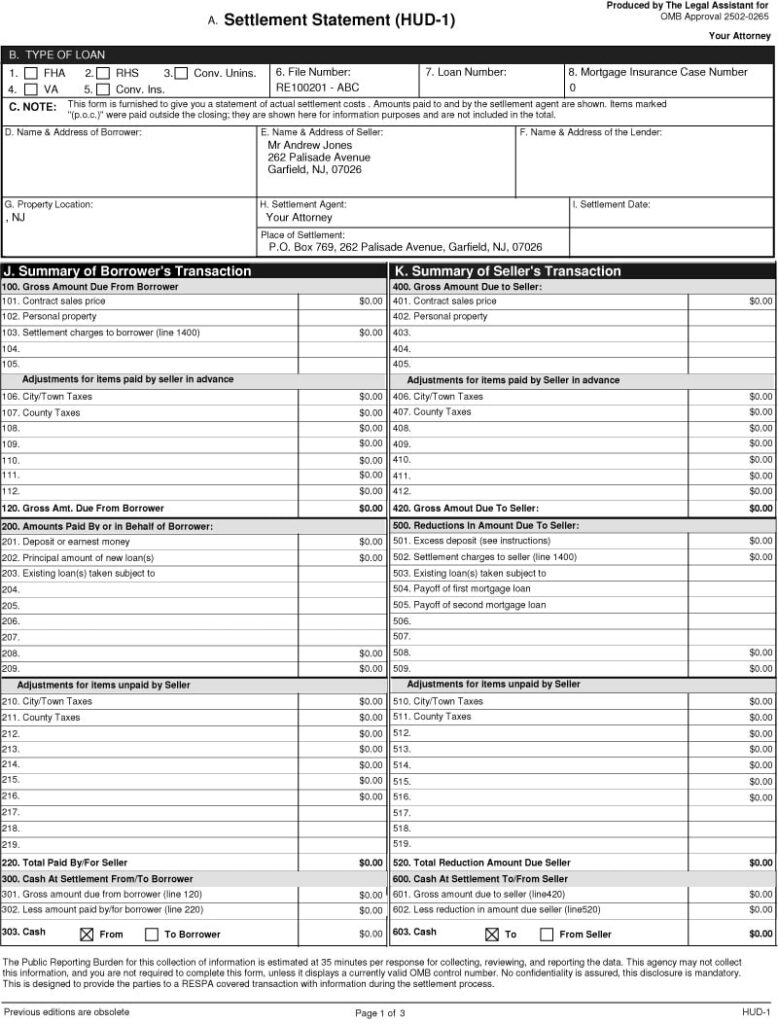

10. HUD-1 Settlement Statement

The HUD-1 Settlement Statement is a standard form used in real estate transactions that provides a detailed breakdown of the financial aspects of the sale. This document includes information on the purchase price, closing costs, fees, and adjustments. Providing the lender with a copy of the HUD-1 Settlement Statement from the original purchase can help establish the property’s purchase price and provide context for the short sale negotiation.

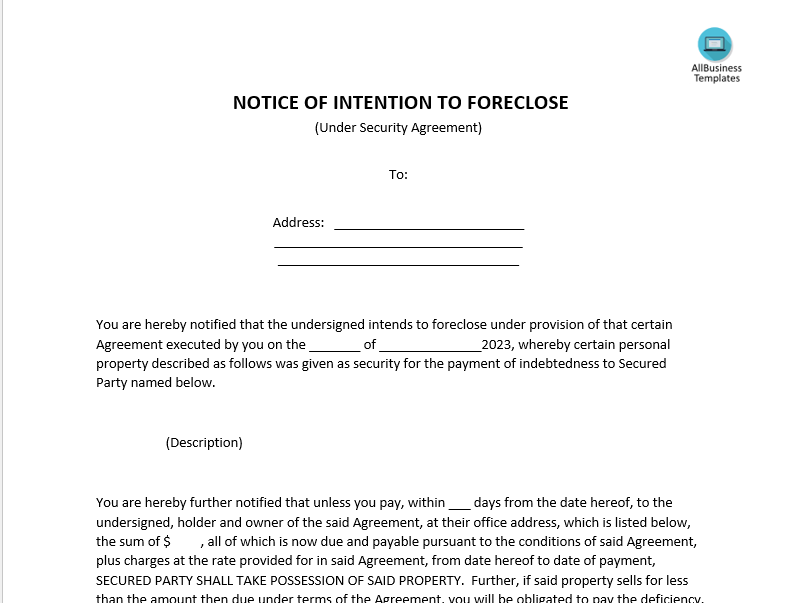

11. Bankruptcy and Foreclosure Documents

If the homeowner has filed for bankruptcy or received any foreclosure notices, it is crucial to include relevant documentation in the short sale package. This includes bankruptcy filing documents, notices of default, or any correspondence related to foreclosure proceedings. These documents help demonstrate the homeowner’s financial hardship and the need for a short sale as a viable alternative to foreclosure.

12. Proof of Identity and Authorization

Include a copy of the homeowner’s identification, such as a driver’s license or passport, to verify their identity. Additionally, include a signed authorization form allowing the lender, real estate agent, or other authorized parties to communicate and negotiate on behalf of the homeowner. This document ensures that all parties involved have the necessary permission to proceed with the short sale transaction.

Conclusion

A successful real estate short sale requires thorough documentation to demonstrate the homeowner’s financial hardship, property value, and ownership. By preparing a comprehensive package of documents, including a well-crafted hardship letter, financial statements, property documents, repair estimates, tax returns, bank statements, and other supporting paperwork, homeowners can streamline the short sale process and present a strong case to their lenders. It is important to stay organized, provide accurate information, and maintain open communication with the lender throughout the short sale transaction. With the right documentation and a proactive approach, homeowners can increase their chances of a successful short sale and find a solution to their financial difficulties while avoiding foreclosure.