Introduction

Loan modification can be a lifeline for homeowners facing financial challenges, allowing them to renegotiate the terms of their mortgage to make it more affordable. However, the loan modification process requires meticulous preparation and submission of various documents. In this article, we will provide a comprehensive list of documents that borrowers need to gather and submit to their lenders in 2023. These documents serve as proof of income, expenses, financial hardship, and overall financial stability. By having all the necessary paperwork ready, borrowers can increase their chances of obtaining a favorable loan modification outcome and potentially avoid foreclosure.

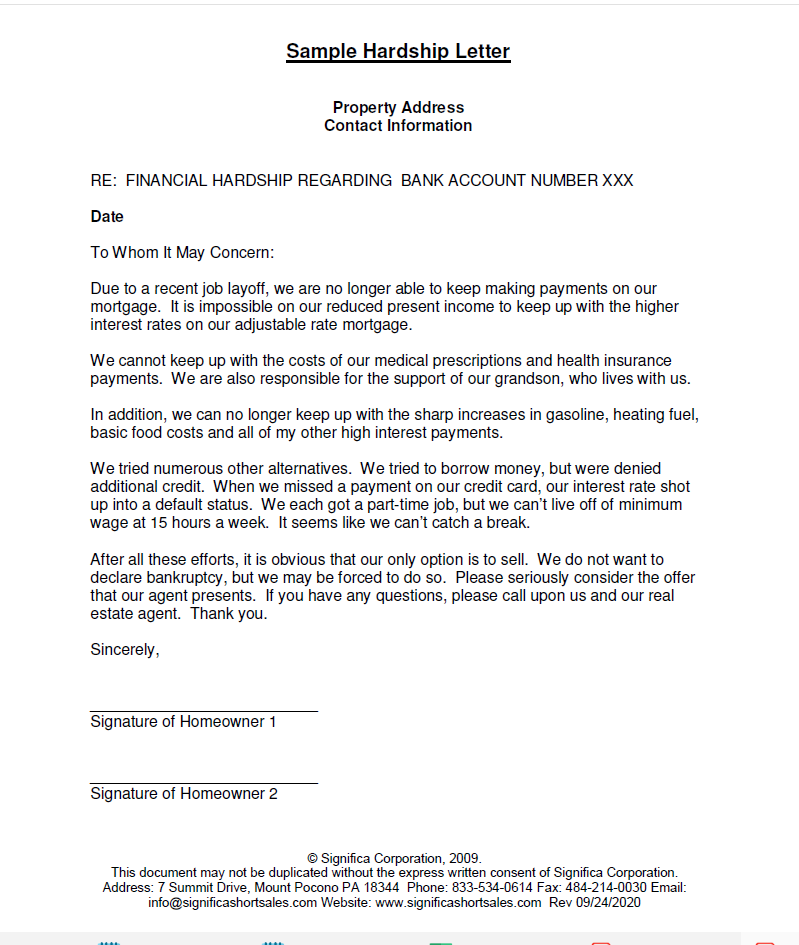

Hardship Letter

A well-crafted hardship letter is an essential document that explains the borrower’s financial difficulties and the reasons for seeking a loan modification. It is important to be concise, honest, and compelling in the letter. Clearly outline the circumstances that led to the financial hardship, such as job loss, reduction in income, medical expenses, divorce, or any other relevant factors. Express the intent to continue making mortgage payments if granted a loan modification. To strengthen your case, provide any supporting documents, such as medical bills, termination notices, or divorce decrees, to validate the claims made in the hardship letter.

Proof of Income

Lenders require borrowers to submit proof of income to evaluate their ability to make modified mortgage payments. This may include recent pay stubs, W-2 forms, or income tax returns. Self-employed individuals should provide profit and loss statements, business tax returns, and bank statements. It is essential to provide comprehensive and accurate information to demonstrate a stable income source. If there have been any recent changes in employment or income, include documentation to support those changes, such as severance letters or new employment contracts.

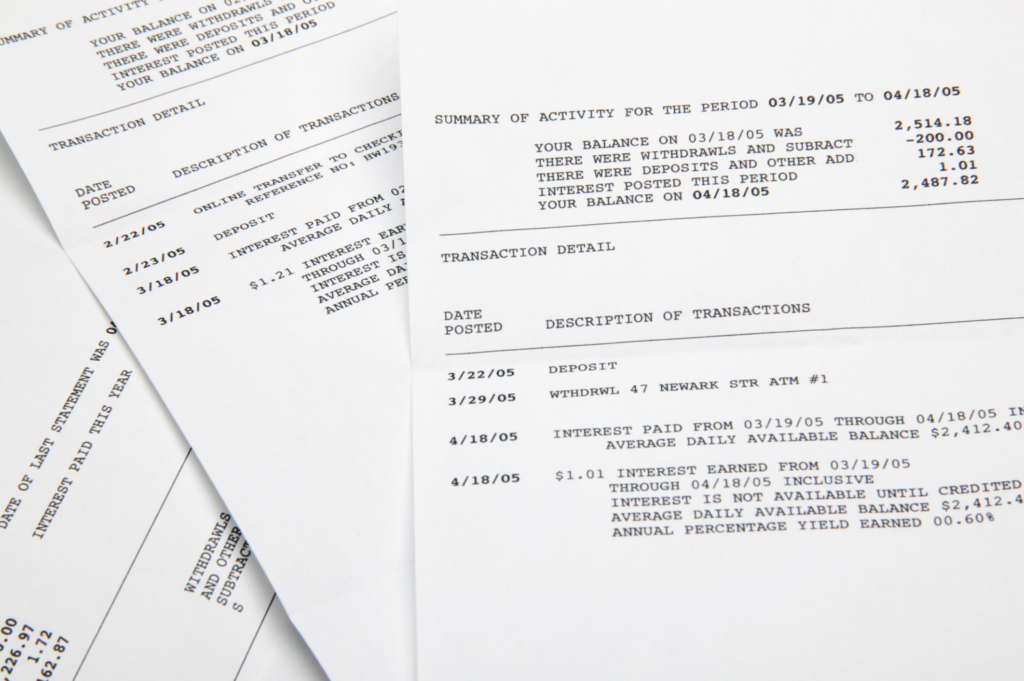

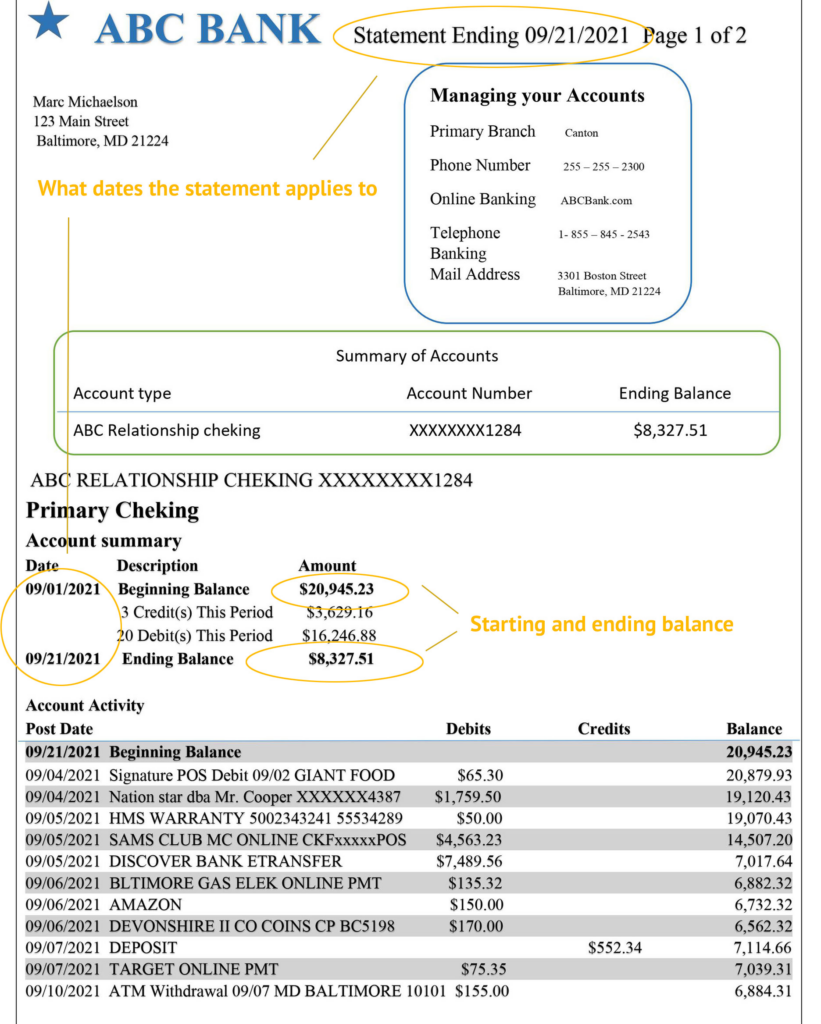

Bank Statements

Lenders typically request bank statements covering the last three to six months. These statements provide a detailed record of the borrower’s financial transactions, including deposits, withdrawals, and account balances. They help assess the borrower’s financial stability and evaluate whether the modified mortgage payments are affordable. Make sure to provide statements for all accounts, including checking, savings, investment, and retirement accounts. Avoid any unusual transactions that may raise questions or cause confusion during the evaluation process.

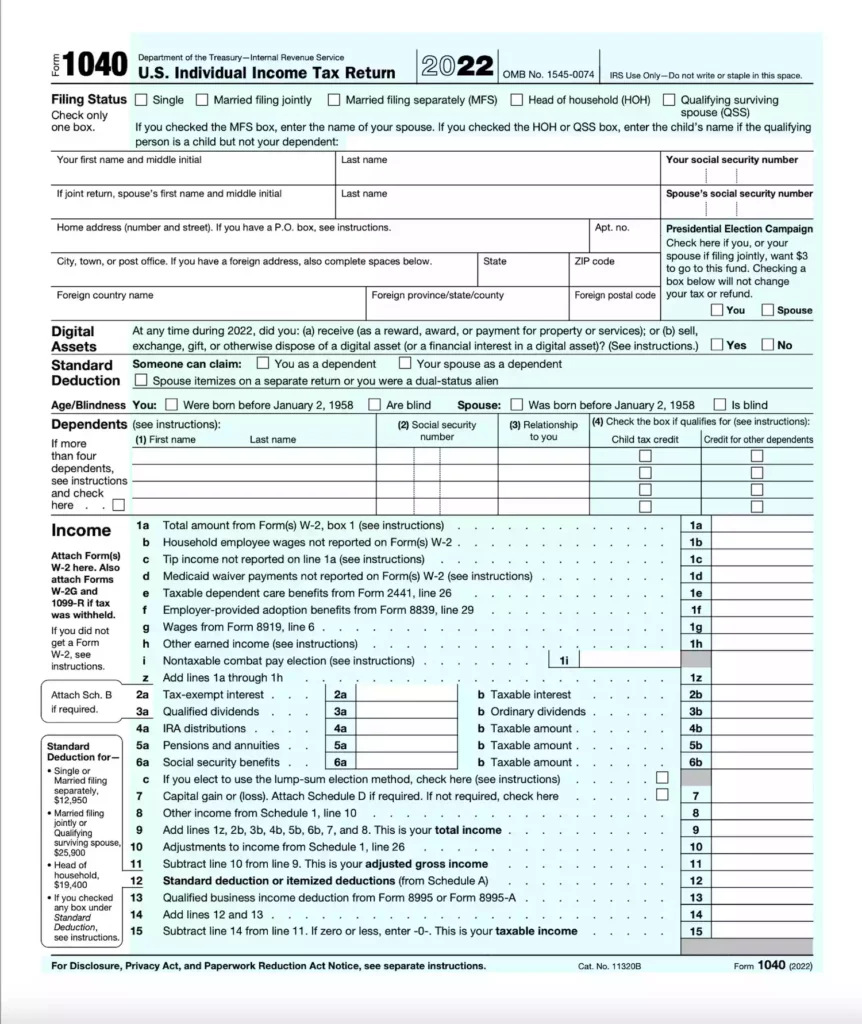

Tax Returns

Recent tax returns, usually for the past two years, are often required to validate the borrower’s income and assess their overall financial situation. Provide both personal and business tax returns if applicable. Make sure to include all relevant schedules and attachments. This information allows lenders to determine the borrower’s debt-to-income ratio, verify the reported income, and evaluate the overall financial health. If there have been any significant changes in income or deductions, provide an explanation and supporting documentation.

Expense Documentation

Borrowers need to provide documentation of their monthly expenses to support their loan modification request. This includes utility bills, credit card statements, insurance payments, medical bills, and any other regular expenses. It is important to provide accurate and up-to-date information to establish a clear picture of the borrower’s financial obligations and affordability. Additionally, providing a detailed budget or expense worksheet can demonstrate responsible financial management and a commitment to sustaining the modified mortgage payments. Be prepared to explain any significant changes in expenses or any extraordinary circumstances that impact the monthly budget.

Additional Documents

Depending on the specific circumstances, additional documents may be required. For example, if you have filed for bankruptcy, provide the bankruptcy discharge papers and related documents. If you have received any foreclosure or collection notices, include them to demonstrate the urgency and need for a loan modification. Other documents that may be relevant include divorce decrees, child support orders, or proof of disability.

Conclusion

Navigating the loan modification process in 2023 requires thorough preparation and submission of the necessary documents. By compiling a comprehensive list of documents, including a well-crafted hardship letter, proof of income, bank statements, tax returns, expense documentation, loan documents, credit report, property valuation, proof of homeownership, and any additional relevant documents, borrowers can present a strong case to their lenders. Being organized and providing accurate information increases the likelihood of a successful loan modification outcome and helps borrowers retain their homes and achieve long-term financial stability.