Introduction:

Loan modification is an important tool for homeowners who are struggling to keep up with their mortgage payments. In today’s real estate market, where many homeowners are facing financial difficulties due to the COVID-19 pandemic, loan modification has become an increasingly popular option for those who want to avoid foreclosure and stay in their homes. In this comprehensive guide, we will explore what loan modification is, how it works, and why it’s important for homeowners in 2023.

At its most basic level, loan modification involves changing the terms of your existing mortgage in order to make your monthly payments more affordable. This can be done in a variety of ways, such as reducing your interest rate, extending the term of your loan, or even forgiving a portion of your principal balance. The goal of loan modification is to help homeowners who are struggling to keep up with their mortgage payments avoid foreclosure and stay in their homes.

One of the key benefits of loan modification is that it can help homeowners achieve a more affordable mortgage payment. This can be especially important for those who have experienced a change in their financial situation, such as a job loss or medical emergency. By reducing your monthly mortgage payment, loan modification can help you free up more money for other expenses, such as bills, groceries, and healthcare.

However, loan modification is not without its challenges. It can be a complex and time-consuming process, and not all homeowners are eligible for loan modification. Additionally, loan modification can have an impact on your credit score, so it’s important to understand the potential consequences before you apply.

Types of Loan Modification:

There are several types of loan modification available to homeowners who are struggling to keep up with their mortgage payments. Each type of loan modification has its own eligibility requirements and benefits, so it’s important to understand the differences between them before you decide which one is right for you.

1. Interest Rate Reduction: An interest rate reduction involves lowering the interest rate on your mortgage in order to reduce your monthly payments. This can be a great option for homeowners who are struggling to make their mortgage payments due to a high interest rate. In some cases, an interest rate reduction can be permanent, while in other cases it may only be temporary. It’s important to understand the terms of your interest rate reduction before you agree to it.

2. Term Extension: A term extension involves extending the length of your mortgage in order to reduce your monthly payments. This can be a good option for homeowners who need to reduce their monthly payments in order to stay in their homes. However, keep in mind that a term extension will increase the total amount of interest you pay over the life of your mortgage.

3. Principal Reduction: A principal reduction involves reducing the amount of principal you owe on your mortgage. This can be a good option for homeowners who owe more on their mortgage than their home is worth, as it can help to bring the principal balance closer to the actual value of the home. However, principal reductions are relatively rare and may only be available in certain circumstances.

4. Forbearance: Forbearance involves temporarily reducing or suspending your mortgage payments for a certain period of time. This can be a good option for homeowners who are facing a short-term financial hardship, such as a medical emergency or temporary job loss. However, keep in mind that forbearance does not forgive any of the principal or interest you owe on your mortgage, and you will still be required to make up the missed payments in the future.

5. Loan Refinancing: Refinancing your mortgage involves replacing your existing mortgage with a new one that has more favorable terms, such as a lower interest rate or a shorter term. Refinancing can be a good option for homeowners who are struggling to make their mortgage payments and have good credit. However, keep in mind that refinancing may require you to pay closing costs and other fees, so it’s important to weigh the costs and benefits before you decide to refinance.

6. Partial Claim: A partial claim is a loan from the Federal Housing Administration (FHA) that can help homeowners who have fallen behind on their mortgage payments. The partial claim pays off any overdue payments and sets up a repayment plan for the homeowner to pay back the partial claim loan over time. To be eligible for a partial claim, you must have an FHA-insured loan and be at least four months behind on your mortgage payments.

7. Loan Modification Programs: There are several loan modification programs available to homeowners who are struggling to make their mortgage payments. These programs are offered by the federal government and private lenders and may have different eligibility requirements and benefits. For example, the Home Affordable Modification Program (HAMP) is a federal loan modification program that offers eligible homeowners a lower interest rate, extended term, or principal reduction to make their mortgage payments more affordable.

It’s important to note that not all lenders participate in loan modification programs, and some programs may only be available for a limited time. Additionally, loan modification programs may have strict eligibility requirements, so it’s important to research each program carefully before applying.

Understanding the different types of loan modification available can help you make an informed decision about which option is right for you. Keep in mind that each type of loan modification has its own eligibility requirements and benefits, so it’s important to consider your individual financial situation and goals before you decide which one is right for you. In the next section, we will explore the benefits of loan modification and how it can help you avoid foreclosure and stay in your home.

The Benefits of Loan Modification:

Loan modification can provide several benefits for homeowners who are struggling to keep up with their mortgage payments. Here are some of the key benefits of loan modification:

1. Avoiding Foreclosure: One of the primary benefits of loan modification is that it can help you avoid foreclosure. If you’re unable to make your mortgage payments, your lender may initiate foreclosure proceedings, which can result in the loss of your home. Loan modification can help you avoid foreclosure by making your monthly mortgage payments more affordable, which can help you get back on track with your payments.

2. Reducing Monthly Mortgage Payments: Loan modification can help you achieve a more affordable monthly mortgage payment, which can help you free up more money for other expenses, such as bills, groceries, and healthcare. This can be especially important if you’ve experienced a change in your financial situation, such as a job loss or medical emergency.

3. Rebuilding Equity in Your Home: If you owe more on your mortgage than your home is worth, loan modification can help you rebuild equity in your home. By reducing your principal balance or interest rate, loan modification can help you get closer to the actual value of your home, which can be important if you’re considering selling your home in the future.

4. Protecting Your Credit Score: Loan modification can help protect your credit score by preventing a foreclosure or bankruptcy on your credit report. While loan modification may have a temporary impact on your credit score, it’s generally considered less damaging than a foreclosure or bankruptcy.

5. Achieving Long-Term Financial Stability: By making your mortgage payments more affordable, loan modification can help you achieve long-term financial stability. This can be especially important if you’re facing a short-term financial hardship, such as a medical emergency or temporary job loss.

6. Helping You Stay in Your Home: Loan modification can help you stay in your home, which can be important if you have strong ties to your community or if moving is not a viable option for you. By making your mortgage payments more affordable, loan modification can help you avoid the stress and financial strain of moving or finding a new place to live.

7. Providing a Fresh Start: For homeowners who are struggling to keep up with their mortgage payments, loan modification can provide a fresh start and a path towards financial stability. By reducing your monthly mortgage payment or principal balance, loan modification can help you get back on track with your payments and achieve a more secure financial future.

8. Helping You Avoid Bankruptcy: Loan modification can also help you avoid bankruptcy, which can have serious long-term consequences for your credit score and financial stability. By providing a more affordable monthly mortgage payment, loan modification can help you avoid the need for bankruptcy and protect your credit score.

It’s important to keep in mind that loan modification is not a one-size-fits-all solution, and it may not be the right option for everyone. Before you apply for loan modification, it’s important to consider your individual financial situation and goals, and to explore other options such as refinancing or selling your home.

However, if you’re facing financial difficulties and want to stay in your home, loan modification can be a viable option to help you achieve long-term financial stability and protect your home from foreclosure. In the next section, we will explore how to prepare for loan modification and navigate the loan modification process.

Preparing for Loan Modification:

Before you apply for loan modification, it’s important to understand the process and prepare accordingly. Here are some steps you can take to prepare for loan modification:

1. Assess Your Financial Situation: The first step in preparing for loan modification is to assess your financial situation. Take a look at your income, expenses, and debts to determine how much you can realistically afford to pay each month towards your mortgage. This will help you determine which type of loan modification may be best for your individual situation.

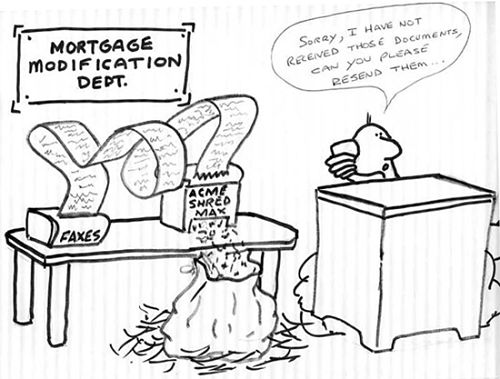

2. Gather the Necessary Documents: To apply for loan modification, you will need to provide your lender with several documents, including proof of income, bank statements, tax returns, and a hardship letter explaining why you need loan modification. Gather these documents ahead of time to ensure that you have everything you need when you submit your application.

3. Contact Your Lender: Once you’ve assessed your financial situation and gathered the necessary documents, contact your lender to discuss your options for loan modification. Your lender will be able to provide you with information about the types of loan modification available and the eligibility requirements for each option.

4. Understand Your Lender’s Requirements: Each lender may have different requirements for loan modification, so it’s important to understand your lender’s specific requirements. This may include meeting certain income or debt-to-income ratio requirements, providing documentation of your hardship, or completing a trial payment period to demonstrate your ability to make your new mortgage payment.

5. Be Prepared to Negotiate: Negotiation is an important part of the loan modification process, as you and your lender will need to come to an agreement on the terms of your modified mortgage. Be prepared to negotiate with your lender, and consider seeking the assistance of a housing counselor or attorney to help you navigate the negotiation process.

Navigating the Loan Modification Process:

Once you’ve prepared for loan modification, it’s time to navigate the loan modification process. Here are some steps you can take to navigate the loan modification process:

1. Submit Your Application: The first step in the loan modification process is to submit your application to your lender. Be sure to provide all of the necessary documentation and information, and follow up with your lender to ensure that they have received your application.

2. Complete the Trial Payment Period: Many lenders require homeowners to complete a trial payment period before their loan modification is finalized. During this period, you will need to make your modified mortgage payment on time each month to demonstrate your ability to make the new payment.

3. Respond to Requests for Information: Your lender may request additional information or documentation during the loan modification process. It’s important to respond to these requests in a timely manner to avoid delays in the process.

4. Negotiate the Terms of Your Modified Mortgage: As mentioned earlier, negotiation is an important part of the loan modification process. Be prepared to negotiate with your lender to come to an agreement on the terms of your modified mortgage, such as the interest rate, monthly payment, and length of the loan.

5. Finalize the Modification: Once you and your lender have agreed to the terms of your modified mortgage, you will need to sign the modification agreement and make any necessary payments. Be sure to read the agreement carefully and understand the terms of your modified mortgage before you sign.

6. Seek Professional Assistance: Navigating the loan modification process can be challenging, especially if you’re unfamiliar with the process. Consider seeking the assistance of a housing counselor, attorney, or other professional to help you navigate the process and negotiate with your lender.

7. Keep Track of Your Progress: Throughout the loan modification process, it’s important to keep track of your progress and stay in communication with your lender. Keep a record of all of your communication with your lender, including emails, phone calls, and letters, and make note of any deadlines or requirements.

8. Be Patient: Loan modification can be a lengthy process, so it’s important to be patient and persistent. Keep in mind that the loan modification process may take several months, and that there may be delays or setbacks along the way.

Here are some tips to help you navigate the loan modification process:

1. Be Honest and Transparent: When applying for loan modification, it’s important to be honest and transparent about your financial situation. Provide your lender with all of the necessary documentation and information, and be upfront about any challenges or obstacles you’re facing.

2. Keep Good Records: Throughout the loan modification process, it’s important to keep good records of all of your communication with your lender, as well as any documentation or information you provide. This will help you stay organized and ensure that you have all of the necessary information to navigate the process.

3. Understand the Process: Loan modification can be a complex process, so it’s important to understand the steps involved and the timeline for completion. Research the loan modification process and become familiar with the requirements and eligibility criteria for each option.

4. Be Patient and Persistent: As mentioned earlier, loan modification can be a lengthy process, so it’s important to be patient and persistent

5. Seek Professional Assistance: If you’re struggling to navigate the loan modification process on your own, consider seeking the assistance of a housing counselor, attorney, or other professional. These professionals can help you understand your options, negotiate with your lender, and ensure that you’re making the best decision for your financial future.

6. Be Prepared for Setbacks: Loan modification can be a complex and challenging process, and setbacks may occur along the way. Be prepared for delays or setbacks, and don’t give up if your initial application is denied. Work with your lender to understand why your application was denied, and explore alternative options or opportunities to modify your mortgage.

7. Keep Up with Your Modified Mortgage Payments: Once your loan modification is finalized, it’s important to make your modified mortgage payments on time each month. Failing to make your payments can result in the loss of your home, so it’s important to stay on top of your payments and seek assistance if you’re struggling to make your payments.

Alternatives to Loan Modification:

While loan modification can be a viable option for homeowners who are struggling to make their mortgage payments, there may be other alternatives available as well. Here are some alternative options to consider:

1. Refinancing: Refinancing your mortgage involves replacing your existing mortgage with a new one that has more favorable terms, such as a lower interest rate or a shorter term. Refinancing can be a good option if you have good credit and want to reduce your monthly mortgage payment.

2. Selling Your Home: If you’re unable to afford your mortgage payments and don’t want to pursue loan modification or refinancing, selling your home may be a viable option. While selling your home can be stressful, it can also provide a fresh start and help you avoid the long-term consequences of foreclosure.

3. Deed in Lieu of Foreclosure: A deed in lieu of foreclosure involves voluntarily transferring ownership of your home to your lender in order to avoid foreclosure. This option can be a good alternative to foreclosure, but it’s important to understand that it may have an impact on your credit score.

4. Short Sale: A short sale involves selling your home for less than what you owe on your mortgage. While a short sale can help you avoid foreclosure and protect your credit score, it’s important to understand that you may still be responsible for paying the difference between the sale price and your outstanding mortgage balance.

Each alternative option has its own benefits and drawbacks, so it’s important to consider your individual financial situation and goals before you decide which option is right for you. Additionally, each option may have its own eligibility requirements and application process, so it’s important to research each option carefully before you make a decision.

Ultimately, the goal is to find a solution that allows you to stay in your home and maintain your financial stability. Whether you choose loan modification or an alternative option, the key is to be proactive and seek assistance if you’re struggling to make your mortgage payments.

The Legal Aspects of Loan Modification:

Loan modification can involve complex legal issues, and it’s important to understand the legal aspects of the process before you begin. Here are some legal considerations to keep in mind when pursuing loan modification:

1. Contractual Obligations: When you signed your original mortgage agreement, you entered into a contract with your lender that outlines your obligations as a borrower. Before pursuing loan modification, it’s important to review your original mortgage agreement to ensure that you understand your contractual obligations and the terms of your agreement.

2. State and Federal Laws: Loan modification is regulated by both state and federal laws, and it’s important to understand the legal requirements and regulations that apply in your state. Research the laws that govern loan modification in your state, and ensure that you comply with all of the necessary requirements and regulations.

3. Potential Legal Risks: Loan modification can involve potential legal risks, such as the risk of fraud or misrepresentation. Be sure to work with reputable professionals and seek legal advice if you have any concerns about the legality of your loan modification agreement.

4. Foreclosure Laws: If you’re unable to reach a loan modification agreement with your lender, foreclosure may be a possibility. It’s important to understand the foreclosure laws in your state and the potential consequences of foreclosure, such as the impact on your credit score and the loss of your home.

5. Bankruptcy Laws: In some cases, bankruptcy may be a viable option for homeowners who are struggling to make their mortgage payments. However, bankruptcy can also have long-term consequences and should only be considered as a last resort. It’s important to understand the bankruptcy laws in your state and seek legal advice if you’re considering this option.

In addition to these legal considerations, it’s also important to ensure that you understand the terms of your loan modification agreement before you sign. Be sure to read the agreement carefully and seek legal advice if you have any questions or concerns.

Frequently Asked Questions:

Here are some common questions that homeowners may have about loan modification:

1. What is loan modification? Loan modification involves modifying the terms of your existing mortgage to make your monthly payments more affordable. This can include reducing your interest rate, extending the term of your mortgage, or reducing your principal balance.

2. How do I know if I’m eligible for loan modification? Eligibility requirements for loan modification vary depending on your lender and the specific program you’re applying for. However, generally, you must be able to demonstrate financial hardship and provide proof of income to be eligible for loan modification.

3. How long does the loan modification process take? The loan modification process can take several months, and the timeline may vary depending on your lender and the specific program you’re applying for. It’s important to be patient and persistent throughout the process.

4. Will loan modification hurt my credit score? Loan modification may have an impact on your credit score, but the impact is typically less severe than the impact of foreclosure. It’s important to understand the potential impact on your credit score before you pursue loan modification.

5. Can I apply for loan modification if I’m already in foreclosure? In some cases, you may still be able to apply for loan modification even if you’re already in foreclosure. However, it’s important to act quickly and seek professional assistance to ensure that you have the best chance of success.

6. Can I negotiate the terms of my modified mortgage? Yes, negotiation is an important part of the loan modification process. You can negotiate the terms of your modified mortgage with your lender, such as the interest rate, monthly payment, and length of the loan.

7. What happens if my loan modification application is denied? If your loan modification application is denied, you may have the option to appeal the decision or explore alternative options, such as refinancing or selling your home.

8. Do I need to hire a professional to help me with loan modification? While it’s possible to navigate the loan modification process on your own, many homeowners choose to hire a housing counselor, attorney, or other professional to assist them. These professionals can provide guidance and support throughout the process and help you understand your options.

9. Can I apply for loan modification if I have a second mortgage? Yes, it’s possible to apply for loan modification if you have a second mortgage. However, the process may be more complex, and you may need to negotiate with both lenders to reach an agreement.

10. What happens after my loan modification is finalized? After your loan modification is finalized, you will need to make your modified mortgage payments on time each month to maintain the terms of your agreement. It’s important to stay on top of your payments and seek assistance if you’re struggling to make your payments.

These are just a few of the common questions that homeowners may have about loan modification. If you have additional questions or concerns, be sure to speak with your lender or seek the assistance of a housing counselor or attorney.

Conclusion:

Loan modification can be a valuable tool for homeowners who are struggling to make their mortgage payments and avoid foreclosure. By modifying the terms of your existing mortgage, you can make your monthly payments more affordable and achieve long-term financial stability.

However, loan modification can be a complex and time-consuming process, and it’s important to approach the process with patience, persistence, and preparation. By understanding the loan modification process, researching your options, and seeking professional assistance if necessary, you can successfully modify your mortgage and achieve your financial goals.

Throughout this guide, we’ve explored the various aspects of loan modification, including the benefits and drawbacks, eligibility requirements, application process, and legal considerations. We’ve also provided information on alternative options, such as refinancing, selling your home, and deed in lieu of foreclosure.

Ultimately, the decision to pursue loan modification or an alternative option depends on your individual financial situation and goals. However, regardless of the option you choose, it’s important to be proactive and seek assistance if you’re struggling to make your mortgage payments.

We hope that this guide has provided you with valuable information and resources to help you navigate the loan modification process. Remember, the key to success is to stay informed, stay organized, and stay focused on your long-term financial stability.

If you’re considering loan modification or an alternative option, be sure to research your options, understand the process, and seek professional assistance if necessary. With the right approach and mindset, you can successfully modify your mortgage and achieve the financial stability you deserve.

Thank you for reading “The Comprehensive Guide to Loan Modification in 2023.” We hope that this guide has been helpful and informative, and we wish you the best of luck as you navigate the loan modification process.